Business Angel Capital

Get Business Angel Capital

Secure Business Angel Capital for Your Startup

Our AI-driven platform connects you with a global network of high-profile angel investors, spanning various industries, stages, and countries. Unlike traditional methods, we don't rely on mass or cold emails. Instead, we facilitate warm introductions to ensure meaningful connections.

How We Help You

Match with the Right Investors: We find investors who align with your startup's vision and goals.

Warm Introductions: We personally introduce your startup to potential angel investors.

Dedicated Follow-Up: Our team manages communication and follows up with interested angels.

Legal and Negotiation Support: We provide expert legal advice to help you negotiate favorable terms.

Deal Closure Assistance: We guide you through closing the investment deal, ensuring the best terms for both parties.

Let us help you secure the right funding to bring your startup to the next level.

Book a Meeting

Let's discuss how we can help you raise capital from angel investors

Get Business Angel Capital for Your Startup

Angel investors are a preferred funding source for startups at all stages. They not only provide financial support but also bring valuable business expertise and advice, contributing significantly to the growth and success of startups.

Even established businesses seek angel capital to fuel their expansion. Angel investors offer more than just money—they bring industry knowledge, experience, and access to influential networks, making them a vital part of a startup's success.

Why Choose Angel Investors?

Financial Support and Expertise: Angel investors help startups grow rapidly by offering funding and business insights.

Growth Opportunities: They contribute to both early-stage and growth-stage companies, helping them reach their full potential.

Passionate about Success: Angels are typically passionate about entrepreneurship and want to see businesses succeed.

Sector Knowledge: They often have a deep understanding of the industries they invest in and can provide unique opportunities for growth.

The Challenge of Finding the Right Angel Investors

Finding the right angel investors can be tough due to limited resources and connections. Angel investors have specific investment criteria, focusing on certain industries, stages, and locations. Randomly contacting angels usually doesn’t work, as their interests might not be fully disclosed on platforms like Crunchbase. Success rates for entrepreneurs raising capital on their own are very low—less than 0.1%.

How We Can Help

Customized Matching: We match you with angel investors based on your startup’s stage, industry, and location, considering their investment history.

Warm Introductions: We facilitate introductions through our network, ensuring a personal connection with potential investors.

Pitch Preparation: We help you review and improve your pitch deck, business plan, and financial model to make sure they are investor-ready.

Let us help you find the right angel investors to take your startup to new heights.

Comprehensive Angel Capital Services

Our angel capital services include:

Funding Plan: We help determine the right amount of capital to raise and the equity to offer.

Startup Valuation: We assess your startup's value to ensure you offer the right equity amount.

Negotiation Support: We guide you through negotiations with angel investors to secure favorable terms.

Deal Closure: We assist in finalizing the deal to ensure both parties are satisfied.

Let us help you navigate the funding process with ease and confidence.

💡 Smart Investor Matching

Always check an angel investor's profile before reaching out. Avoid contacting investors who have backed competitors to protect your idea from being stolen or replicated. Ensuring the right fit is crucial for the success and security of your startup.

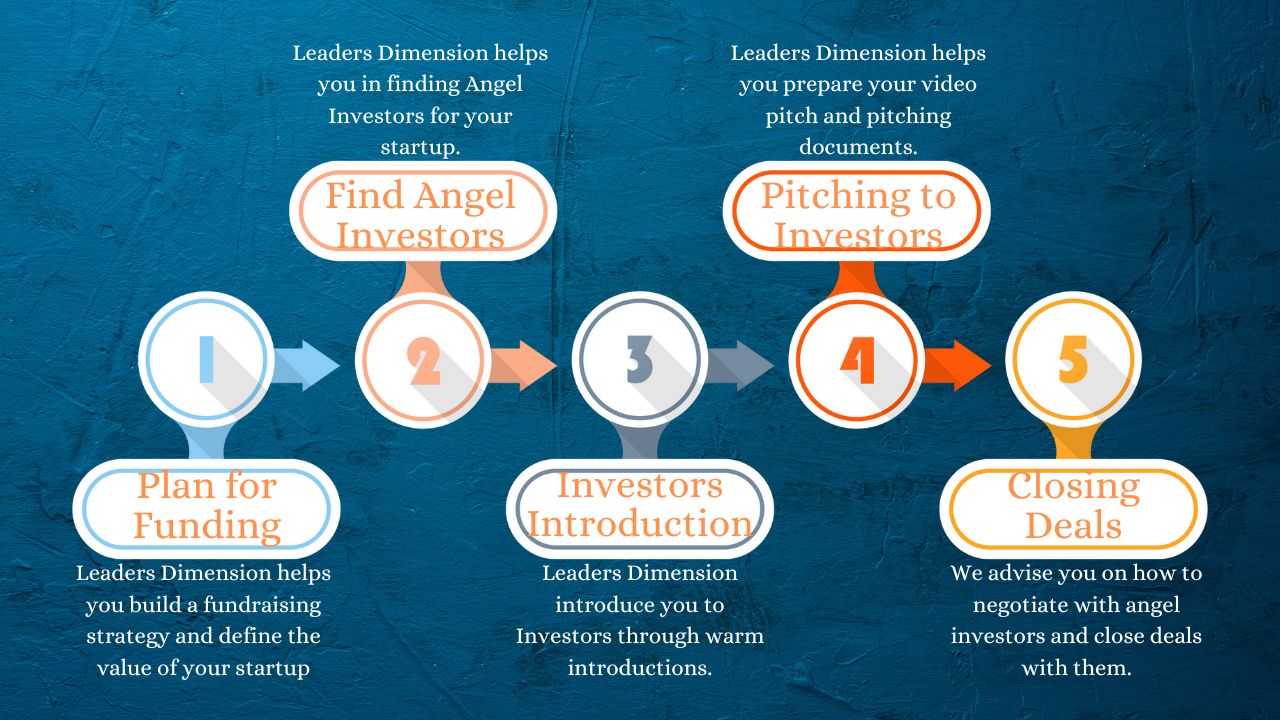

Plan for Securing Business Angel Capital

If you want to raise money from angel investors, you'll need a solid plan. Here are five tips to help you prepare for your fundraising effort:

Know Your Numbers: Understand your business's financial position. Compile a comprehensive financial report detailing your revenues, expenses, and cash flow. This insight will help you identify necessary improvements and demonstrate your financial stability to investors.

Build a Strong Case for Investing: Create a compelling pitch deck that showcases your business's strengths and outlines how the funds will be used. Include detailed budget and revenue projections to give investors a clear picture of your financial strategy and growth potential.

Craft an Elevator Pitch: Develop a concise 30-second elevator pitch that captures the essence of your business. This quick overview should intrigue investors and make them eager to learn more about your startup.

Prepare for Interviews: Begin recruiting angel investors by reaching out to your network, including friends and family who might be interested. Utilize platforms like AngelList to publish information about your company and connect with potential investors.

Stay Positive and Motivated: Fundraising can be challenging, but stay optimistic. Angel investors are looking for high-potential businesses, so maintain a positive attitude and keep pushing forward.

Creating a Fundraising Strategy

Before approaching angel investors, it's crucial to have a clear fundraising strategy. This not only demonstrates your seriousness but also helps you set priorities and establish clear timelines for each milestone during the funding round.

Funding Plan Service: We help you create a detailed funding plan with specific milestones for each round of funding.

Startup Valuation: We determine the right amount to raise and the equity to offer by providing a fair valuation of your startup.

Milestone Planning: We advise on how much to raise and how to break it down to maximize your chances of success while minimizing equity dilution.

Raising Strategy: We guide you on the likely amount you can raise and the expected timeframe to secure the funds.

Let us assist you in crafting a robust fundraising strategy to enhance your chances of securing business angel capital and achieving your growth goals.

💡 Quick Tip

As a general rule, aim to dilute less than 15% of your startup's equity in each funding round. This way, founders can still retain majority ownership even after three to four funding rounds. However, in the early stages, when risks are higher, you might need to offer up to 20% equity to attract an angel investor.

Valuing Your Startup for Business Angel Capital

To secure angel capital, it's crucial to accurately value your startup. Here are three common methods used:

Market Valuation: This method assumes your startup is worth what someone is willing to pay for it. It's commonly used but difficult to calculate accurately. The most precise market valuation comes from an initial public offering (IPO), but many startups do not go public, making this method less reliable for early-stage companies.

Net Present Value (NPV): NPV values your startup based on future cash flows, considering that future income is more valuable than immediate cash. It subtracts the initial investment from the projected future cash flows. This method is accurate but may not fully account for the risks involved with startups.

Internal Rate of Return (IRR): IRR calculates the return on investment by estimating the future cash flows your startup will generate over time. It is more complex than NPV but provides a detailed view of both the risks and rewards.

Choosing the Right Valuation Method

Each method has its pros and cons:

Market Valuation: Easy to calculate but often inaccurate for early-stage startups.

NPV: Accurate for estimating future cash flows but doesn't fully account for startup risks.

IRR: Complex but offers a comprehensive view of potential returns and risks.

Our Valuation Service

Accurately valuing your startup is essential to determine how much equity to offer investors. Our startup valuation service includes:

Selecting the Right Valuation Method: We choose the method that best fits your startup's stage and circumstances.

Comparative Analysis: We compare your startup to others with similar business models, stages, and industries.

Revenue and Cash Flow Consideration: We incorporate your revenue and cash flow into the valuation process.

Let us help you establish a fair and accurate valuation for your startup, ensuring you give up the right amount of equity to attract angel investors while preserving your ownership.

Find Angel Investors and Secure Business Angel Capital

Business angel capital is essential for financing startups. Here’s how to find angel investors effectively:

Steps to Finding Angel Investors

Know Your Business and Goals: Be honest and clear about your business and what you aim to achieve. Angel investors are interested in companies with clear directions and realistic goals.

Manage Expectations: Be realistic about what you expect from investors. They often invest small amounts initially but look for a good return on their investment. Clearly outline your business plan and how you plan to achieve your goals.

Network Widely: Network with as many angels as possible. Not all will be interested, so casting a wide net increases your chances of finding the right match.

How We Help

Our global network of angel investors is interested in startups from various industries and stages. we use an advanced AI system to match you with the right investors.

How Our AI System Works

AI Matching: Our deep learning system, featuring a neural network and natural language processing (NLP) component, identifies relevant keywords for your startup.

Expert Analysis: An expert reviews the AI’s output to avoid mistakes and ensure your information isn’t sent to competitors.

Warm Introductions: We introduce you to angel investors through warm introductions and act as the first point of contact.

Pitch Support: We offer advice on improving your pitch and review your pitch deck, business plan, and financial model based on feedback from a small circle of investors.

Smart Angels Network

We connect you with angel investors who offer not only funding but also business advice and mentorship, tailored to your situation and needs.

What Angel Investors Look For

High Growth Potential: Show traction through revenue, user numbers, and market demand. Highlight these in your pitch documents.

Skilled Leadership Team: Demonstrate that your team has the skills and experience needed to succeed. Investors look for committed, innovative, and highly-skilled teams.

Good Market Opportunity: Provide detailed market research showing the size, growth rates, and demand in your target market. A scalable business model is crucial.

High Rate of Return: Investors seek a high return on investment. Highlight your startup’s track record and market demand to showcase potential returns.

Tips for Finding Angel Investors

Leverage Your Networks: Use your personal and professional connections to find interested investors.

Attend Investor Events: Go to events relevant to your industry to meet potential investors and learn about their preferences.

Reach Out to Venture Capitalists Early: Approach venture capitalists with a solid plan and roadmap to pique their interest.

Ask Friends and Family: Tap into your immediate network for initial investment and leads.

Use Online Platforms: Utilize online directories and platforms to find angel investors interested in funding startups.

By following these steps and leveraging our services, you can effectively find and secure angel capital to grow your startup.

💡 Quick Tip

We focus on finding angel investors who bring "smart money"—those who offer expertise, connections, and more to support your startup's growth.

We also target anchor angel investors who are willing to invest in multiple funding rounds (pre-seed, seed, Series A, Series B, and beyond) and can lead these funding rounds.

Get Introduced to Angel Investors and Secure Business Angel Capital

Meeting and pitching to investors can be challenging, and how you approach them matters. Searching for angel investors online limits you to your existing network, missing out on new opportunities. Relying on platforms like LinkedIn or Facebook often results in sending cold invitations, which are typically ineffective.

Leaders Dimension offers a better approach. We connect you with angel investors through shared or common connections, increasing your chances of getting noticed and receiving a positive response. This method enhances your credibility and improves the likelihood of successful interactions with potential investors.

Pitching to Investors and Securing Business Angel Capital

When pitching your startup to investors, keep these key points in mind:

Know Your Numbers: Be ready to provide concise and compelling financial details. Investors want to know your business's worth, potential, and what it will take to reach your goals. Build a solid financial model to showcase this.

Demonstrate Value Proposition: Clearly articulate what your product or service does for customers and how it benefits them. Investors need to understand the value you bring.

Prove Traction: Show evidence of your business's growth and potential for continued success. Highlight how your current customers benefit and outline your plan to expand your customer base.

Share Risks: Be transparent about the risks involved in investing in your business and explain how you plan to mitigate them.

Prepare for Tough Questions: Expect challenging questions about your business and its prospects. Be ready to answer candidly and convincingly.

Pitching Process

Pitching to investors involves presenting your startup to external parties, typically for raising capital, presenting services, or exploring partnerships. The format can vary from a quick 3-minute pitch to a detailed hour-long session, and it can be done in person or digitally.

After matching with investors, you will arrange meetings to pitch your startup. Preparation is crucial to ensure you stay on track and cover the important points effectively.

Tips for a Successful Pitch

Research Investors: Understand their mindset and criteria before pitching.

Highlight Competitive Advantages: Showcase the solutions your product or service offers.

Emphasize Growth Potential: Demonstrate the high growth potential and market opportunity of your startup.

Polish Presentation Skills: Practice your pitch to avoid losing track and to engage investors effectively.

Leverage Shared Connections: Use shared connections to gain attention and credibility.

Showcase Team Strength: Highlight your team’s skills and ability to implement strategies.

Build a Financial Model: Present a financial operating model that highlights growth potential and cash flow.

Create a Pitch Video: A dynamic video presentation can leave a positive impression.

How We Help You Pitch Successfully

Avoid Common Mistakes: Our team identifies common pitching mistakes and helps you avoid them.

Training and Feedback: Through our Raise Capital program, we train you to pitch effectively and provide feedback from an investor's perspective.

Improve Pitch Materials: We help refine your pitch deck, business plan, and financial model to ensure they are well-written and compelling.

Expand Your Reach: We feature your startup on our website and present your video pitch to a wider audience, offering feedback to enhance its impact.

By following these guidelines and leveraging our support, you can increase your chances of securing business angel capital and successfully pitching to investors.

Closing the Deal and Securing Business Angel Capital

When an angel investor decides to invest in your company, they are betting on your potential to grow and become profitable. For this, they need to be confident in your company's prospects and growth plans.

Steps to Closing the Deal

Due Diligence: The angel investor conducts a thorough investigation, interviewing key team members, analyzing financial data, and reviewing documentation to ensure your company is sound and has a realistic growth plan.

Investment Offer: Once confident, the angel investor will present an investment offer to your management team. If management is receptive, they work together to outline the investment terms in a financial proposal.

Finalizing the Deal: After finalizing the terms, the angel investor provides the funding and additional resources like office space, marketing support, and mentorship, expecting a return on their investment over time.

Negotiation Support

Negotiating with angel investors can be straightforward if you have the right advice and support. Many entrepreneurs lack the legal and negotiation skills needed for fundraising, which can hinder their success. Having an expert to guide you through negotiations can save time and help secure favorable terms.

We support entrepreneurs throughout the negotiation process with angel investors by:

Providing Negotiation Advice: We offer guidance on how to negotiate and which terms to focus on.

Closing the Deal: We assist in finalizing the funding deal and signing the investment agreement, ensuring both sides are satisfied with the terms.

By having expert support during negotiations, you can confidently close deals and secure the capital needed to grow your business.

💡 Quick Tip

In the very early stages of funding, your negotiating position is weaker, so be prepared to make compromises and negotiate with the angel investor.

Raise Business Angel Capital Through Funding Rounds

Angel investing primarily involves two types: venture capital and private equity. Venture capital funds early-stage startups, while private equity targets already successful companies.

There are several ways to raise money through angel investing:

Seed Round: This is the initial funding stage where a company raises money from a group of angel investors. It's typically the smallest round of funding.

Series A Round: This round involves raising funds from both angel investors and venture capitalists. It's usually the largest funding round for a company.

Institutional Round: This involves raising funds from angel investors and venture capitalists, but it is usually more challenging to secure.

Many angel investors prefer early-stage companies with high growth potential. We assist entrepreneurs in securing funding at various stages, from pre-seed and seed rounds to more advanced stages like Series A, Series B, and Series C.

Raise Business Angel Capital Through Funding Rounds

1.1 Get Business Angel Capital Through a Pre-Seed Round

Business angels often invest in early-stage companies, providing initial funding to help the company get started. This funding is typically used for expenses like rent, payroll, and marketing. The two main types of pre-seed funding are convertible notes and equity financing:

Convertible Notes: These are loans that can be converted into equity if the company meets certain milestones.

Equity Financing: This is when an angel investor buys shares of the company, giving them ownership.

Angel investors look for startups with high potential, a strong team, and a clear plan. They want to see evidence that the startup can execute its strategy. Raising capital at the pre-seed stage can be challenging due to the lack of a proven track record. To attract angel investors, you need an innovative idea, a demonstrated market need, and a skilled team.

Through our Idea to Product program, we connect you with angel investors interested in pre-seed startups. We also help validate your idea, prepare your pitching documents, and conduct market research.

1.1.1 Raise Business Angel Capital from the Idea Investor

"Idea investors" are individuals or firms dedicated to helping startups grow. There are three main types of idea investors:

Angel Investors: Invest small amounts, usually from a few thousand to a million dollars, in very early-stage companies.

Venture Capitalists: Invest larger amounts in later-stage companies.

Bootstrappers: Self-fund their own startups.

Idea investors provide more than just money—they offer connections, partnerships, and valuable advice. They often become early board members and decision-makers. Our Idea to Product program connects you with angel investors who offer both funding and mentorship to help your startup succeed.

1.1.2 Raise Business Angel Capital from the Founder Angel

Founder Angels are early-stage investors who provide financial support and business expertise. They have a deep understanding of the startup ecosystem and are passionate about helping companies grow. Founder Angels are often successful entrepreneurs themselves, bringing valuable knowledge and experience.

Finding a Founder Angel is easier than you might think. Use resources like startup incubators, angel networks, and meetups. You can also reach out to friends, family, and professionals in the startup community.

A Founder Angel can be a co-founder in your startup, providing both financial and business support.

1.2 Raise Business Angel Capital Through a Seed Round

Seed funding is for early-stage businesses to test their business model, get early feedback, and develop their product. Angel investors are the primary source of seed funding, as traditional VCs typically avoid this high-risk stage. Angel investors seek startups with a product-market fit.

We help startups find the right angel investors for their seed round through our AI matching system. Our network includes angels interested in various stages, including the seed stage. We also help you define your fundraising goals, valuation, and prepare for negotiations.

1.3 Raise Business Angel Capital Through a Series A Round

Series A funding involves raising capital from both angel investors and venture capitalists. This round focuses on building a long-term relationship with investors. Series A investors are interested in companies with strong growth potential.

We connect you with Series A angel investors who match your industry and stage. We help you break down the funding amount into smaller rounds and work on a fair valuation. Our series A round funding service also includes VC funding options.

1.4 Raise Business Angel Capital Through a Series B Round

Series B funding supports early-stage companies looking to expand their operations. This round is usually the final one before going public or being acquired. Series B investors focus on the long-term prospects of the company.

Connecting with angel investors at this stage can provide additional credibility alongside VC funding. Our series B funding round service matches you with suitable angel investors based on your industry and achievements. We help you value your startup and prepare for negotiations.

In some cases, an angel investor may be willing to invest in multiple rounds or bring in additional investors. Some angels are prepared to invest $1M or more, providing substantial support for your startup's growth.

Types of Investors for Seed, Series A, and Series B Startups

1.1 Raise Business Angel Capital from the Super Angel

Business angel capital refers to the financial support that wealthy individuals or venture capitalists provide to early-stage companies. These investors help startups grow rapidly and achieve profitability.

Super Angels are high-net-worth individuals with over $1 million in personal wealth. They are more selective and typically invest between $250,000 and $1 million in startups, often driving significant growth. Super angels usually participate in seed funding but can also invest in Series A and Series B rounds. They provide substantial funding in exchange for equity but are not interested in long-term involvement or board positions. Super angels look for experienced entrepreneurs and prefer quick investment deals.

To attract a super angel, personal referrals are crucial as they seldom respond to cold emails. We can connect you with super angels through our network, providing warm introductions based on shared connections. We also help you perfect your pitch with our pitch your startup service.

1.2 Raise Business Angel Capital from Specialty Angels

Specialty Angels are investors who focus on specific industries they know well and believe in. These angels provide more targeted support and are highly motivated to help startups succeed within their area of expertise. They offer valuable insights and industry knowledge, increasing the likelihood of a startup's success.

Finding the right specialty angel can be challenging due to their niche focus. We help you connect with specialty angels who align with your industry and provide the necessary support and knowledge to grow your startup.

1.3 Business Angel Capital: The Active Investor

Active Investors are deeply involved in the companies they invest in, providing not only financial support but also strategic guidance and industry connections. They bring "smart money," meaning they contribute expertise, validation, and resources beyond just capital.

Active investors are engaged in decision-making, monitoring progress, and offering valuable feedback. They typically have experience in the same industry or own a related business. This involvement helps ensure your startup gets the support it needs to succeed.

Characteristics of active investors:

>> They participate in business decisions and collaborate with the founding team.

>> They provide ongoing support, feedback, and industry connections.

>> They focus on short-term investments, aiming to see returns quickly.

When matching entrepreneurs with investors, we prioritize active investors unless otherwise requested. We connect you with the right active investor to ensure your startup receives both the financial backing and the strategic support needed to thrive.

💡 Tips for Raising Money from Angel Investors

1. Reach Out to Many Angels

Connect with as many angel investors as possible. This increases your chances of finding the right match for your business.

2. Research and Target the Right Angels

Not all angels invest in every type of company. Do your homework to find angel groups or individual investors who are interested in your industry. Reach out to them directly.

3. Be Prepared with Comprehensive Documentation

Angel investors need detailed information about your business before making a decision. Ensure you have all necessary documents ready, including:

>> Financial statements

>> Product descriptions

>> Customer lists

>> Pitch deck

>> Business plan

>> Financial model

4. Build Strong Relationships with Angels

For an investment deal to succeed, both parties need to be comfortable. Maintain open communication and be organized to meet deadlines and avoid surprises. Don’t hesitate to ask for advice and be willing to consider their suggestions or make changes to meet their preferences.

FAQs about Business Angel Capital

Warm Introductions: We connect you with angel investors through personal, warm introductions via shared connections. We avoid impersonal mass emails or bulk introductions.

Dedicated Team: A dedicated team will work closely with your startup, handling the entire process of matching and connecting with investors.

Partnership and Support: We partner with you in the capital raising process, covering 50% of the package cost to support your startup.

Typically, the process of matching and connecting with investors takes around 3 months. During this time, we gather feedback and insights to ensure we introduce you to the right angel investors for your startup.

We kickstart by reviewing your pitching documents and gathering feedback from a select group of investors. Then, we strategize the funding rounds and decide on the target amounts. Once everything's set, we initiate the matching process, connecting your startup to our network of investors. Lastly, we assist in negotiating terms with investors and finalizing the deal.

No, Leaders Dimension assists entrepreneurs in raising capital across multiple funding rounds. We help determine the funding amount and startup valuation for each round, aiming for larger targets in subsequent rounds within a defined timeframe.

The fee for Raise Capital service is based on packages tailored to your needs. Packages range from $2000 to $50,000 depending on the number of angel investors you want to connect with and the amount you aim to raise. You can find more details about these packages on our Funding program page.

In our network, we have 155,000 angel investors. Each investor's contribution can range from $50,000 to $1 million. Rest assured, we'll connect you with the right investors based on your funding needs.

To successfully raise angel money, start by identifying the type of investor that aligns with your venture—individual angels, family office angels, or institutional angels. Once you've pinpointed your target audience, craft a compelling business proposal detailing how your company will create value and generate revenue over time. Be ready to address common investor questions, such as your exit strategy. While raising angel money can be challenging, it's a valuable opportunity for funding growth and innovation in your industry.

Angel investing offers a unique chance to engage with early-stage startups seeking initial funding and gauge their potential. By joining early financing rounds, you'll have direct access to founders, gaining valuable insights into startup dynamics and investment evaluations. This firsthand experience can inform your future decisions if you aspire to become an angel investor yourself!

Angel investing typically begins with screening potential companies to identify those with promising potential. Once a promising company is found, an angel investor may invest anywhere from $1,000 to $250,000 into the company to support its growth and development.

Angel investors are usually affluent individuals or families interested in supporting promising businesses. They often seek startups they believe have high potential for success. To be eligible for angel investment, startups should align with the investor's interests and demonstrate growth prospects. It's essential for the investor to have a basic understanding of the proposed business and relevant industry experience.

Securing a deal with an angel investor involves several key steps:

Create a Strong Business Case: Start by analyzing the feasibility of your project and its market potential. Consider factors like market size and financing availability. Our services include business feasibility studies and market research to help you build a compelling case.

Build a Roster of Potential Investors: Identify angel investors who have interests aligned with your venture. Reach out to those who have invested in similar industries or companies. Building a strong investor network is crucial for success.

Pitch Your Startup: Craft a compelling pitch to present your startup to potential investors. Highlight your unique value proposition, market opportunity, and growth potential. Secure commitments from interested investors.

Secure Funding: Once you've garnered interest from angel investors, work towards securing funding for your project. Negotiate terms and close the deal to kickstart your venture.

By following these steps diligently, you can increase your chances of securing a successful deal with an angel investor.

Success after investing in an angel round can be measured by several key indicators:

Achievement of Goals: Success is often gauged by whether the startup achieves its original objectives. This includes goals related to growth, profitability, and market expansion.

Sustainable Growth: Investors assess whether the startup demonstrates sustainable growth and scalability. This involves continuous expansion of the user base, product offerings, and revenues beyond initial projections.

Attractiveness to New Investors: A successful angel round investment may attract interest from new investors or partners, indicating confidence in the startup's potential for further growth.

Execution of Business Model: Investors evaluate how effectively the startup executes its business model. This includes factors such as market penetration, customer acquisition, and product development.

By monitoring these metrics, investors can determine the success of their angel round investments and make informed decisions about future funding and support for the startup.

Business Angel:

Investment Stage: Business angels invest in early-stage, high-growth companies.

Involvement: They are often less involved in day-to-day operations but may provide mentorship and guidance.

Capital: Business angels usually provide equity investment and may offer additional support beyond funding.

Venture Capitalist:

Investment Stage: Venture capitalists typically focus on later-stage investments when companies have proven their potential for growth.

Involvement: They are more actively involved in the management and strategic direction of the company.

Capital: Venture capitalists may provide various forms of capital, including equity, debt, or a combination of both.

While both business angels and venture capitalists provide funding to startups, they differ in their investment stage, level of involvement, and the type of capital they offer.

A typical business angel investor is someone who:

Invests in Familiar Businesses: They often invest in businesses they know or have expertise in.

Sees Potential: They look for companies with great potential for growth and success.

Takes Risks: They are willing to take risks on early-stage ventures that may not have reached their full potential yet.

Business angels are often individuals with experience in specific industries or sectors, and they are motivated to support promising startups in those areas.

The best way to find a business angel is through networking with other entrepreneurs and investors. You can also explore online platforms like Angel List or Venture Source to connect with potential investors who are interested in funding startups.

Angel investors usually invest in startups by providing equity financing directly to the company. They may also invest through venture capital firms or angel groups, which pool funds from multiple investors to invest in a portfolio of startups.

Business angel capital is funding provided by wealthy individuals, known as business angels, to early-stage or startup companies. These angels not only offer financial support but also provide expertise, industry connections, and mentorship to help these companies succeed.

Business angels are individual investors who use their personal funds to invest in early-stage businesses, while venture capitalists manage pooled funds from institutional investors. Business angels usually invest smaller amounts and are more hands-on with the companies they invest in, providing guidance and support. Venture capitalists invest larger amounts and focus on generating high returns for their investors.

Business angels are motivated by both financial and non-financial factors. Financially, they seek attractive returns on their investments by supporting promising startups. Non-financially, they invest to stay engaged with the entrepreneurial community, mentor young entrepreneurs, and potentially access innovative technologies or business opportunities. Explore our Idea to Product program to see how we assist early-stage startups.

Business angels assess investment opportunities based on factors like market potential, team expertise, product uniqueness, competition, and business scalability. They conduct due diligence, which includes market research, financial analysis, and discussions with the founders, before deciding to invest.

Business angels typically invest in early-stage companies, including seed-stage and startup ventures seeking seed funding. These companies are often in the initial stages of development, needing capital for product development, market validation, and early growth. In some cases, angels may also invest in later-stage companies with significant growth potential.

The amount of capital business angels invest can vary widely, depending on the investor and the opportunity. Angel investments can range from a few thousand dollars to several million dollars. On average, angels typically invest between $20,000 to $150,000 per investment, though some may invest more.

Raising business angel capital offers several benefits for early-stage companies. Firstly, it provides vital funds at a stage when traditional financing options may be scarce. Secondly, angels bring valuable industry expertise, networks, and mentorship, aiding in navigating challenges and accelerating growth. Lastly, angels are often more flexible and patient investors than venture capitalists, giving startups time to validate their business model before seeking further funding.

While raising business angel capital can be advantageous, there are potential drawbacks to consider. Angels often expect a substantial return on their investment, which may involve giving up equity or control in the company. Moreover, their involvement can sometimes lead to conflicts or differing opinions on the company's direction. It's crucial for startups to carefully assess investment terms to ensure they align with their objectives.

Business angels usually exit their investments through one of three methods: an initial public offering (IPO), a strategic acquisition by another company, or a management buyout. The choice of exit strategy depends on factors such as the company's growth, market conditions, and the preferences of the investors involved. Having a well-defined exit strategy is essential for business angels when investing in startups.

After investing, business angels typically become actively involved in the companies they support. They serve as mentors, providing guidance and strategic advice to the founding team. They leverage their networks to help the company access resources, customers, or partners. Business angels may also attend board meetings or take on advisory roles, using their expertise to contribute to the company's growth and success.

Entrepreneurs can attract business angel capital by presenting a compelling investment opportunity. This involves creating a solid business plan, showing market potential, highlighting a strong founding team, and emphasizing the uniqueness of the product or service. Networking within the entrepreneurial community, attending pitch events, and seeking introductions to potential angels through industry connections are also effective strategies.

Business angels typically prefer to invest in industries with high growth potential and disruptive technologies. These may include technology startups, healthcare innovation, renewable energy, and consumer products. However, their preferences can vary based on their expertise and interests. Ultimately, business angels seek opportunities where they can leverage their experience and add value beyond just providing capital.

Investing in early-stage companies comes with risks, and business angels are not immune to them. Some common risks include the business failing to gain traction or generate revenue, market competition, regulatory hurdles, and shifts in consumer behavior. Business angels must assess these risks carefully and diversify their investment portfolio to minimize potential losses.

Business angels can effectively manage their investment portfolios by employing several strategies:

Diversification: They should spread their investments across various companies, industries, stages of development, and geographic locations to minimize risk.

Due Diligence: Thorough research and analysis before investing help in understanding the potential risks and rewards of each investment opportunity.

Active Portfolio Management: They should actively monitor their portfolio companies, provide support as needed, consider follow-on investments, and make timely exit decisions based on performance and market conditions.

By implementing these strategies, business angels can increase the likelihood of success and maximize returns from their investment portfolio.

Absolutely! Business angels frequently co-invest alongside venture capitalists or other investors, particularly in larger funding rounds. This collaboration enables them to benefit from the expertise and resources of institutional investors while still maintaining their active involvement in the startup. Co-investing also helps to spread risks, pool capital, and create a more robust support network for the company's growth.

Entrepreneurs can identify potential business angels by tapping into their networks, engaging in industry events, or joining startup accelerators and incubators. Online platforms like angel investor networks or crowdfunding sites are also valuable resources. However, it's crucial to research potential investors thoroughly to ensure they align with the company's goals and investment criteria. Explore our startup online financing service for more assistance.

When assessing investment opportunities, business angels focus on the founding team's experience, skills, and track record. They look for passionate and committed individuals who demonstrate adaptability and a willingness to overcome challenges. A capable and cohesive founding team is seen as a key indicator of potential success by business angels.

Yes, in certain countries, there are tax incentives aimed at encouraging business angel investments. These incentives may involve tax credits, deductions, or exemptions on capital gains or income from such investments. It's advisable for entrepreneurs and investors to seek guidance from tax professionals or local authorities to explore the available benefits in their area.

Business angels can foster diversity and inclusion by actively seeking out opportunities to invest in underrepresented founders or diverse founding teams. They can engage with organizations or networks dedicated to promoting diversity in entrepreneurship, participate in mentorship initiatives, and ensure their investment practices are fair and inclusive. Embracing diversity enables business angels to access a wider range of innovative ideas and contribute to a more inclusive startup community.

Absolutely! Business angels can provide further financial support to their portfolio companies when they require extra capital for expansion or achieving significant goals. This follow-on funding assists in facilitating the company's growth plans and lessens the necessity for founders to seek new investors. Experienced business angels typically reserve a portion of their investment portfolio for such follow-on investments in their established ventures.

The decision for business angels to seek a seat on the board of directors varies. While some may desire direct involvement in strategic decisions, others might prefer advisory roles or informal engagement. The level of participation often hinges on factors like investment size and the dynamics between the investor and the founding team.

Business angels generally anticipate significant returns on their investment due to the high-risk nature of early-stage ventures. While the exact figures can differ, they typically aim for substantial multiples of their initial investment. Commonly, they seek returns ranging from 5 to 10 times their invested capital over a period of about 5 to 7 years.

Yes, business angels can provide debt financing in addition to equity investment. With debt financing, they offer loans to startups, which are repaid over time with interest. This option might suit startups with steady cash flows or specific project needs. However, it's essential to consider regular interest payments, which can affect a startup's finances, especially in the early stages.

Business angels offer more than just funds to startups. They share their experience, industry insights, and connections to help with strategic planning, market expansion, and making valuable introductions. They act as mentors, challenging founders' ideas and providing valuable advice based on their own entrepreneurial experiences.

When a startup fails to meet growth expectations, business angels face tough decisions. They might offer extra support, suggest strategy changes, or, as a last resort, consider exiting the investment. Managing such risks is part of angel investing, requiring careful portfolio management and readiness for setbacks.

Yes, business angels can invest in both local and international startups. However, investing in startups from other countries may involve extra complexities, like navigating different regulations and cultural norms. Despite the challenges, it offers opportunities to access a wider pool of innovative ventures worldwide.

Business angels are instrumental in guiding startups for future funding rounds. They help refine business models, develop financial projections, enhance pitch decks, and pinpoint potential investors. With their extensive networks, they facilitate introductions to venture capitalists and other funding sources, paving the way for the startup's growth.

Business angels' involvement in a startup's day-to-day operations varies. Some prefer a hands-on approach, actively engaging in strategic decisions, while others take a more advisory role. The level of involvement is typically outlined in the investment agreement and may change as the company progresses.

Business angels seek entrepreneurs with passion, resilience, and a growth mindset. They value founders who are receptive to feedback, have a clear vision, and can lead and motivate a team. These qualities are key to building a successful and scalable business.

Business angels are pivotal in the startup ecosystem's growth. Their early investments fuel innovation and economic expansion. They offer expertise, networks, and resources, nurturing budding entrepreneurs. Successful angels often reinvest returns, fostering a cycle of capital and knowledge that propels ecosystem development.