Venture Capital Funding

Venture Capital Funding: Service Description

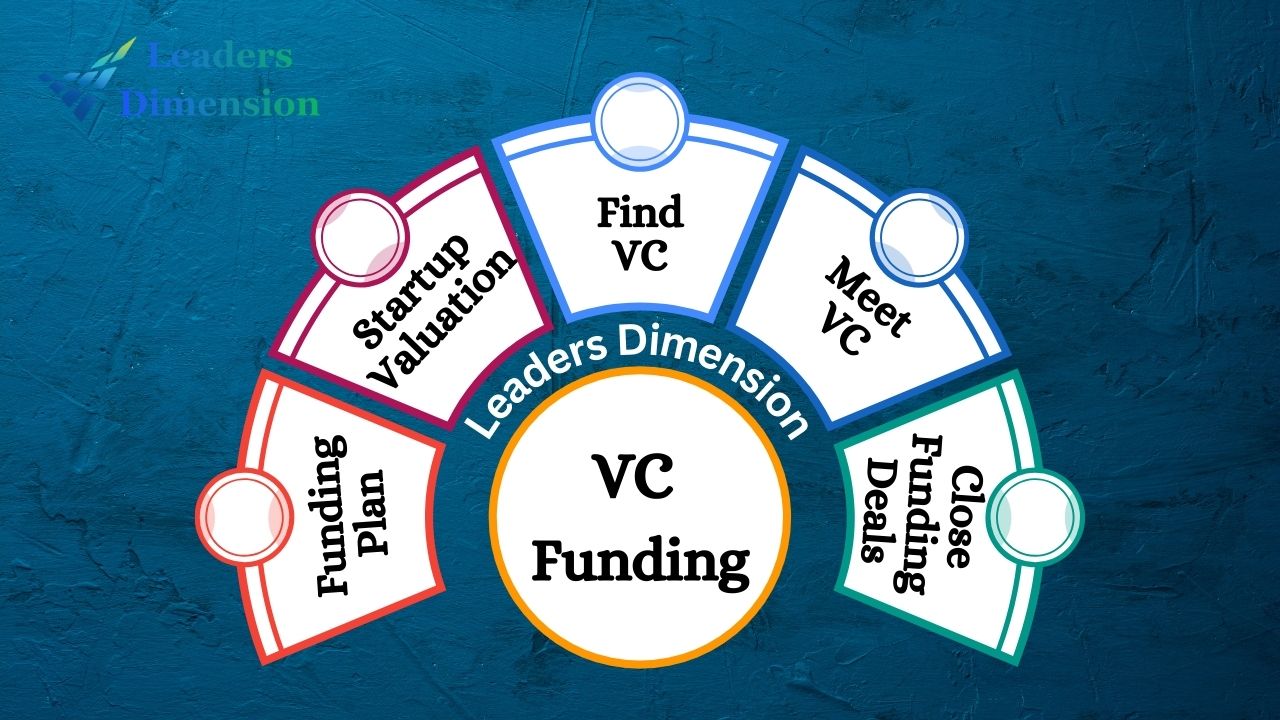

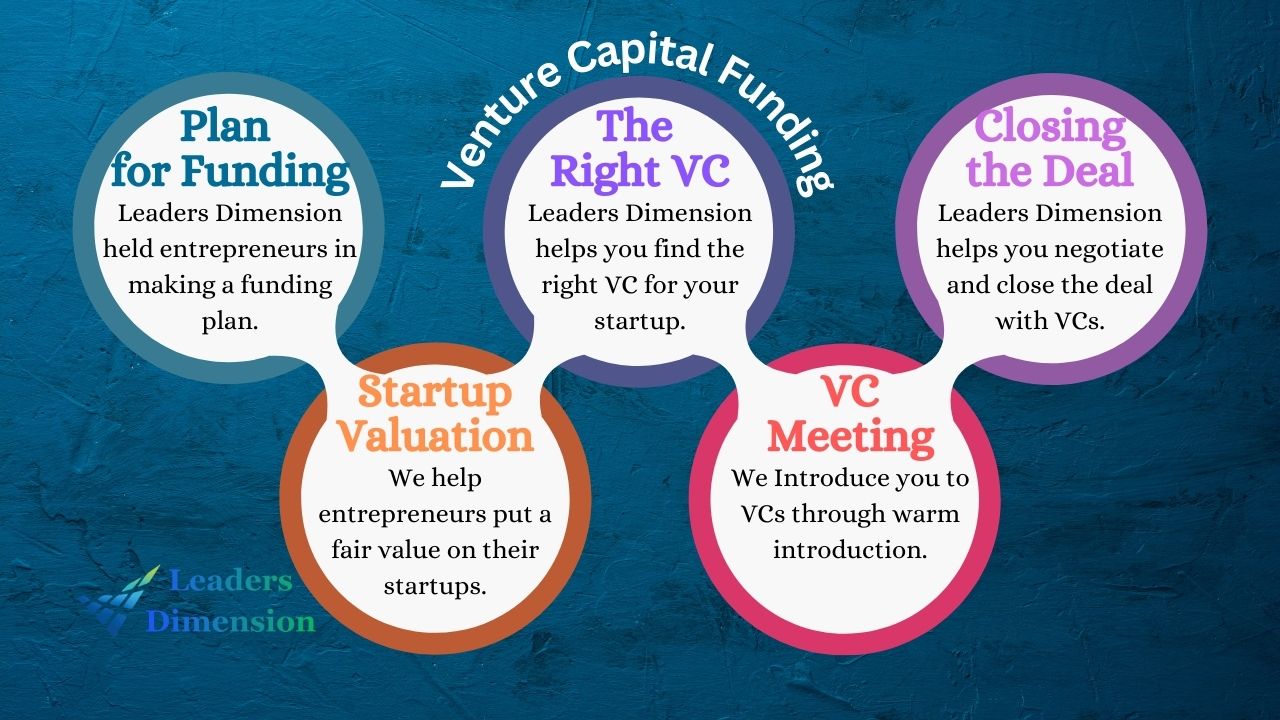

We specialize in helping startups secure venture capital (VC) funding by connecting them with the right investors from our extensive network of VCs and micro-VCs. Our process is designed to match you with investors who are the best fit for your startup’s specific needs, ensuring a higher chance of securing the necessary funds.

Tailored Matches for Your Startup

We understand that every startup is unique, which is why we take the time to match you with VCs that align with your startup’s stage, industry, and geographical location. By focusing on VCs whose investment criteria align with your business, we increase the likelihood of a successful funding round.

Expert Review and Analysis

Our team conducts a thorough review of your pitching materials, including your pitch deck, business plan, and financial model. This meticulous analysis helps us understand your startup’s strengths and potential, which in turn allows us to present your business in the best possible light to potential investors.

Strategic Funding Planning

Determining the right amount of money to raise and the appropriate equity to offer can be challenging. Our experts provide strategic planning services to help you identify these critical factors. We ensure that you are asking for an amount that meets your needs without giving away too much equity, preserving your long-term control and profitability.

Fair Valuation Assistance

A fair valuation is crucial for attracting investors while maintaining your equity stake. We assist entrepreneurs in identifying a fair and realistic valuation for their startups. Our valuation process considers market trends, your startup’s financial health, and future growth potential to arrive at a figure that resonates with investors.

Negotiation and Deal Closure

Securing an investment is only part of the journey. We also support you in negotiating terms that are favorable and closing the deal efficiently. Our team’s experience in deal-making ensures that you get the best possible terms, helping you build a strong foundation for future growth.

End-to-End Support

From the initial connection with potential VCs to the final closing of the deal, we provide end-to-end support throughout the funding process. Our comprehensive services are designed to make the entire process seamless and stress-free for you, allowing you to focus on what you do best: growing your startup.

Why Choose Us?

Our extensive network of VCs and micro-VCs, combined with our detailed and strategic approach, sets us apart. We are committed to helping you navigate the complex landscape of venture capital funding, providing you with the tools and support you need to succeed. Our goal is to make the funding process smooth, efficient, and ultimately successful, enabling you to secure the investment required to take your startup to the next level.

Let us help you unlock the potential of your startup with the right funding and investor connections. Contact us today to start your journey towards securing the venture capital you need to grow and thrive.

Book a Meeting

Get a quote on how we can help you get funded by VCs

Venture Capital Funding

Securing venture capital (VC) funding is a significant advantage for startups, especially during their advanced stages like Series A and Series B funding. VC funding not only injects substantial cash into a business but also opens new doors for growth, builds strong connections, and improves market positioning.

Venture capital is a type of financial investment that fuels business expansion. It complements other forms of investment, such as angel capital or seed funding, providing the necessary funds for companies to develop and scale.

Venture capitalists are seasoned investors who are willing to invest in new businesses, even with some uncertainty about their success. Their primary goal is to achieve a return on investment (ROI) through both profits and increased company value. To make informed decisions, VCs require detailed information about the business, including financial models, market analysis, and product plans.

Many entrepreneurs struggle to raise VC capital and find interested firms due to limited resources and data. VCs can be selective, often investing only in specific industries, countries, or companies with certain income levels. Approaching VCs and presenting a startup effectively can be challenging for those lacking expertise and resources in this area.

To address this, we use warm introductions to VCs, ensuring they hear about your startup from trusted contacts. We collaborate with any angel investors who have previously invested in your startup, assisting in introductions, negotiations, and closing deals with VCs.

VC funding is a challenging process due to several factors:

>> Negotiations with VCs take considerable time.

>> Unlike angel investors, you must convince multiple people at the VC firm to close the deal.

>> Many VCs are overwhelmed with existing deals and prioritize their current portfolio companies over new investments.

>> Most VCs are understaffed.

Unlocking Venture Capital: Your Funding Blueprint

Launching a business is thrilling, but navigating funding can be daunting. Venture capital offers a robust solution, but without a solid plan, your efforts might fall short. Here’s how to craft a winning strategy:

Define Your Market: Target your audience with precision. Understand who they are and how to reach them. This clarity will shape your marketing budget.

Crunch the Numbers: Calculate your startup costs, from initial investments to ongoing expenses. Leave room for surprises and growth spurts.

Know Your Equity: Decide how much ownership you're willing to part with. Balancing equity with funding needs is crucial.

Plot Your Growth: Map out your journey to profitability. Understand when to seek additional funding and when to hit the accelerator.

Showcase Your Potential: Prepare to impress. Build a robust financial model to highlight your startup’s value and potential. This will be your ace in negotiations.

We specialize in crafting bespoke funding plans tailored to your startup’s needs. From defining investment amounts to securing the right VC partner, we’ve got you covered. Let’s unlock your venture capital journey together!

💡 Pro Tip: Mastering VC Funding

Here’s a golden rule: transparency wins. Present multiple funding options upfront. Stay flexible on amounts and usage plans. And hey, why not spice it up with dynamic valuations based on future scenarios?

Expect the unexpected. Funds might trickle in, not pour. Prepare for delays without letting it cramp your style. Buffer up your financial plan to dodge any last-minute cash crunch.

Remember, stress-free startups are the best startups. Let’s craft a plan that keeps your operations smooth sailing, no matter what.

Maximize Your Startup's Value: From Traction to Funding, We've Got You Covered!

Unlocking the potential of your startup begins with understanding its true value. At Leaders Dimension, we specialize in helping entrepreneurs like you pinpoint the perfect valuation for your venture, ensuring a fair exchange of equity and maximizing your chances of securing vital venture capital funding.

Our approach is straightforward yet comprehensive. Using a blend of tried-and-tested valuation methods like RFS, DCF, and VCM, we delve into the heart of your business to determine its worth accurately. This not only aids in negotiations with investors but also lays a solid foundation for future growth.

But valuation is just one piece of the puzzle. We also recognize the power of traction when it comes to wooing potential investors. That's why we advocate for breaking down fundraising into manageable rounds, starting with securing support from angel investors. This not only injects credibility and momentum into your startup but also positions it favorably for larger investments down the road.

With Leaders Dimension, you're not just navigating the complexities of startup valuation; you're charting a course toward success, one strategic step at a time. Let's unlock your startup's full potential together.

💡 Pro Tip: Steering Your Startup's Valuation: Navigating Optimism to Win Over Investors!

Forecasting the future is a common practice among entrepreneurs, but the accuracy of those predictions can make or break a deal. While optimism is essential for driving innovation, relying solely on ambitious forecasts might give potential investors cold feet.

That's why we advocate for a dynamic valuation approach, grounded in achievable milestones and tangible progress. By setting the right Key Performance Indicators (KPIs) and metrics, we craft a formula that directly links your startup's growth to its valuation.

With this proactive strategy, we not only attract investors but also instill confidence in the journey ahead. Let's turn your startup's potential into a compelling investment opportunity!

Unlocking Venture Capital: Your Path to Funding Success!

Venture capitalists are the lifeblood of startups, offering not just capital but invaluable guidance and connections. But finding the right VC is key to securing that support.

Start by understanding the VC landscape. Consider factors like investment strategy, size, and location, as well as the personalities of individual investors. Building a strong relationship means being transparent about your progress and receptive to advice.

Avoid the common pitfall of approaching the wrong VC by doing your homework. Research their background, investment history, and criteria to ensure alignment with your startup's goals.

Where to Find Venture Capital?

Start with angel investor networks, where early-stage startups find initial funding. Attend industry events and network tirelessly to make connections. Keep an open mind – every connection counts.

If traditional VC routes aren't accessible, explore crowdfunding, corporate partnerships, or private equity firms. Be clear about the type of relationship you seek with investors.

At Leaders Dimension, we streamline the process with our Raise Capital program. Leveraging our extensive VC network and AI matchmaking, we connect you with the perfect VC fit for your startup's needs. Let's pave the way to funding success together!

💡 Start Early, Win Big: Navigating VC Investment for Your Startup!

When it comes to securing venture capital, timing is everything. Identifying the right VC partners and initiating conversations early can make all the difference in your startup's journey.

Don't be deterred if your startup hasn't hit the $500k annual revenue mark yet. It's still worth reaching out to VCs who may be interested in future opportunities. A simple email expressing interest can plant the seed for future collaboration once you reach that milestone.

At Leaders Dimension, we understand that building relationships with VCs takes time. That's why we advocate for starting conversations early, even during the early funding stages. Let's kickstart your VC journey and pave the way for your startup's success!

Mastering VC Meetings: Your Ticket to Startup Success!

VC meetings are the gateway to potential investments, providing a platform for startups to showcase their vision and growth potential. Typically structured with an overview followed by a pitch, these meetings offer a chance to highlight your company's journey and future plans.

But beyond the formalities, the real magic happens in networking. Connecting with new faces and gaining valuable advice can propel your startup forward. After the meeting, it's crucial to document every detail discussed, refining your strategy for future funding opportunities.

Securing VC meetings can be challenging. Mass cold emails often fall flat, with response rates hovering below 0.2%. That's why we believe in the power of warm introductions, leveraging shared connections to boost response rates to 20%-40%.

At Leaders Dimension, we go the extra mile by reviewing your pitching documents beforehand. By ensuring your pitch deck, business plan, and financial model are top-notch, we set the stage for a successful meeting that makes your startup shine. Let's pitch your way to success!

💡 Quick Tip

Mastering VC Meetings: How to Prepare for Success!

Preparing for a VC meeting isn't just about showing up; it's about understanding what the VC is looking for and aligning your pitch accordingly. Here's how to nail it:

Start Early: Preparation begins with the first email exchange. Understand the VC's investment preferences and approach.

Listen and Adapt: Pay attention to the VC's feedback. Are there concerns about your fundraising strategy or potential risks? Address them head-on.

Do Your Homework: Dive into the VC's portfolio. Get insights from startups they've funded, especially recent ones. This provides valuable context for your pitch.

At Leaders Dimension, we've got your back every step of the way. From background research on key players to refining your pitch, we ensure you're ready to make a lasting impression. Let's set the stage for your startup's success!

Closing the Deal: Securing Venture Capital Funding

Negotiating with VCs can be a complex and lengthy process, often involving multiple decision-makers and factors. Unlike simpler negotiations with angel investors, closing a deal with VCs requires careful navigation.

At Leaders Dimension, we streamline this process for you. We assist with payment terms, discussions, and provide strategic advice on scenarios and KPIs to ensure successful capital raising. We also offer legal guidance when it's time to sign the papers.

These negotiations typically take around three months, but with our expertise, we help you avoid common pitfalls that can delay funding. Let us help you close the deal efficiently and successfully!

Get Micro VC and VC Funding

Micro VCs are gaining popularity for several reasons. They are accessible to small companies, agile in their investment approach, and focus on growth over profit. This makes them an excellent choice for startups looking to make a significant market impact quickly.

Advantages of Micro VCs:

Affordability: More cost-effective than traditional VCs, allowing startups to invest in new technology and hire talent.

Early-Stage Focus: Better positioned to support early-stage companies, increasing the chances of success.

Growth-Oriented: Prioritize growth over profit, reducing the risks associated with high-profit ventures.

Types of Micro VCs:

Micro VCs Operating Like VCs: Invest in early-stage startups with funding amounts ranging from $20K to $500K.

Micro VCs Operating Like Angel Groups: Groups of angel investors led by one or two angels, investing $20K to $200K. These are easier to deal with as decisions are made by individual investors without strict criteria.

Connecting with micro VCs can be challenging since many operate informally without a public presence. At Leaders Dimension, we have a vast network of micro VCs and can facilitate introductions. We assist entrepreneurs in preparing compelling pitch materials and improving pitching skills to attract investments from angel investors and their networks.

Let us help you secure the funding you need to grow your startup with the support of micro VCs!

💡 Quick Tip

If you need to raise smaller amounts, consider reaching out to micro-VCs for funding between $20K and $700K. Micro-VCs can often provide funding more quickly and efficiently.

Even for larger amounts, like $1M to $3M, having a micro-VC cover part of the funding can be beneficial because:

>> They respond quickly, allowing you to secure funds sooner.

>> Their involvement can strengthen your negotiating position with larger VCs, showing multiple parties are interested.

>> They can offer bridge financing, helping you stay afloat while you seek larger investments.

Leverage the agility and speed of micro-VCs to boost your fundraising efforts and improve your chances with bigger VCs.

Types of Venture Capital Funding

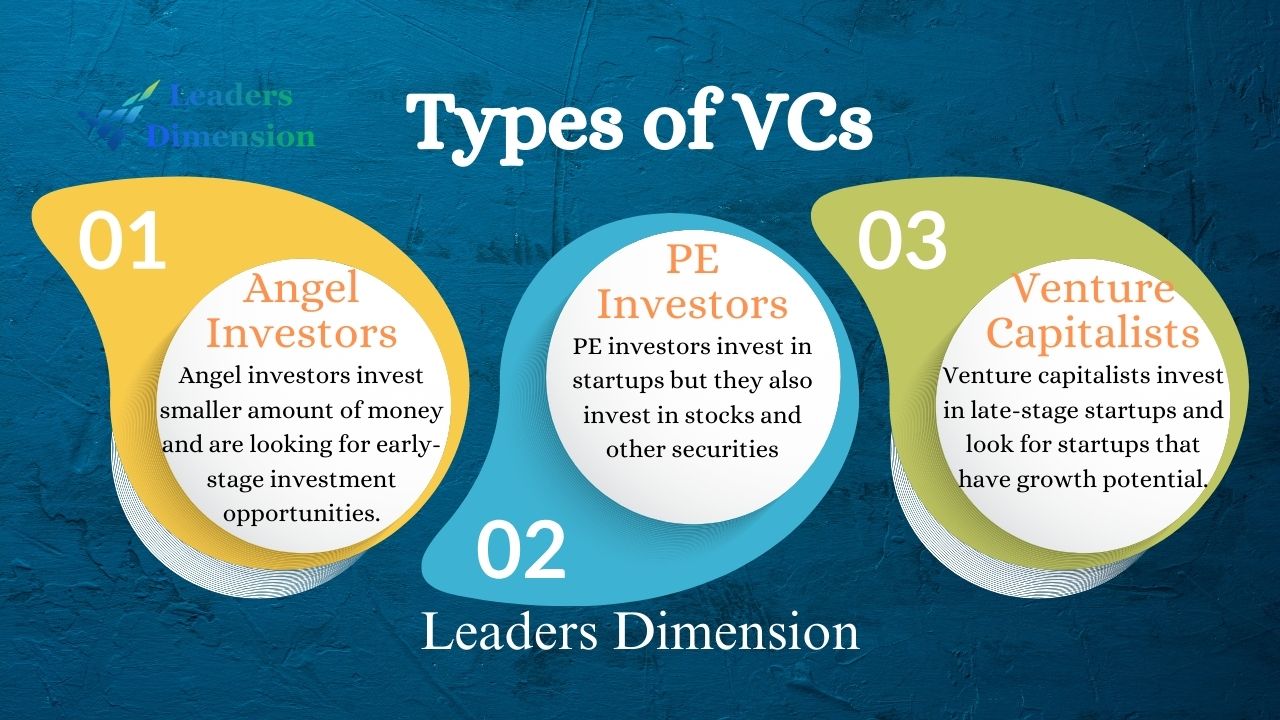

There are three main types of venture capitalists: angel investors, venture capitalists, and private equity (PE) investors.

Angel Investors: Angel investors are often misunderstood. While some believe they are only wealthy individuals, most angels are self-made entrepreneurs or experienced business people. They typically invest $20,000 to $50,000 in early-stage startups, seeking good value for their investments. Angels contribute smaller amounts and focus on early-stage opportunities.

Venture Capitalists: Venture capitalists (VCs) invest in later-stage companies, willing to take on more risk for the potential of high returns. They look for businesses with the potential to become billion-dollar enterprises.

Private Equity (PE) Investors: Private equity investors are wealthy individuals or groups who provide equity financing to companies. They invest in businesses, aiming to improve them for a profitable sale or IPO. Unlike VCs, PE investors also invest in stocks and other securities, often with larger sums and a more aggressive approach.

Understanding these types of venture capital funding can help you target the right investors for your startup's stage and needs.

💡 Quick Tip

Tips for Raising Venture Capital

Make a Compelling Business Case

Show investors that your company is a worthy investment with strong growth potential. Provide detailed financials, market analysis, and projections to support your vision.

Market Yourself Effectively

Convince investors that your company is not only financially sound but also strategically valuable. Highlight how your product or service benefits society or the economy.

Be Prepared for Tough Questions

Investors will scrutinize every aspect of your business, from its origins to its future plans. Be ready to share comprehensive details confidently.

Diversify Your Investor Base

Avoid relying on a single source of funding. Seek backing from a variety of investors across different regions and sectors to spread risk and align with diverse goals for your company.

Implementing these tips can significantly improve your chances of securing venture capital.

FAQ About Venture Capital Funding

Securing VC funding is challenging due to the competitive nature of the startup market. VCs receive hundreds of funding requests daily, making them highly selective. They look for startups with scalable business models and strong traction. Common challenges include:

Lack of Traction: Without enough market traction, it’s tough to convince VCs of your startup’s potential.

Wrong Approach: Approaching the wrong VCs or failing to research their investment preferences can hinder your chances.

To improve your odds, ensure your business model is scalable, demonstrate significant traction, and thoroughly research potential VCs before reaching out.

Business Growth and Opportunities: VC funding not only provides essential capital but also opens new doors for business growth and expansion.

Strong Connections and Networks: Securing VC funding helps build valuable connections and networks, which are crucial for your startup's growth and entry into new markets.

Access to Large Capital: Unlike angel investors, who typically invest between $20,000 and $500,000 per round, VCs can provide much larger amounts of capital. This makes VC funding ideal for startups in advanced stages looking to scale up quickly.

The amount of equity VCs take depends on your startup's stage, valuation, and the amount they invest. It also varies based on how involved the VC will be. Typically, VCs take between 25% and 50% of the startup's equity.

VCs typically seek startups with strong traction, a solid track record, and consistent revenue. They look for innovative and promising business ideas worth investing in. Many VCs have specific investment criteria, often focusing on particular industries, stages, and locations.

To determine if your startup is attractive to VCs, consider these factors:

Strong Idea and Founders: Is your idea solid, and do the founders have a successful track record?

Scalability: Can your startup grow and create value for both customers and shareholders?

Growth Potential: Is there potential for explosive growth?

If you can confidently say yes to these questions, your startup may be a good target for VC investment.

The amount of investment a startup receives can vary for several reasons:

Company Specifics: Factors like the company's unique capabilities and market potential play a role in attracting investment.

Founder Skills: Some startups excel at pitching their ideas and networking with investors, increasing their chances of securing funding.

Ultimately, it's a combination of factors that determine why some startups receive more investment than others.

Venture capital comes in three main types:

Early Stage: Invested in startups with less than $2 million in revenue, helping them get off the ground.

Growth Stage: Invested in companies with established revenue, aiding in scaling up or expanding their offerings.

Exit Stage: Invested in companies preparing to go public, positioning them for future success in the public market.

These types cover the funding needs of startups at various stages of development.

Venture capital operates through funding rounds, where investors provide capital to startups. Here's how it typically works:

Funding Rounds: VC funds are raised in rounds, with each round attracting investment from individual or group investors.

Round Sizes: Rounds typically range from $250,000 to $2 million, with smaller rounds falling between $250,000 and $500,000, and larger rounds exceeding $500,000.

These rounds help startups secure the funding they need to grow and develop their business.

VCs invest in startups because they see potential for success. They aim to earn a return on their investment, but they also want to support the growth and success of the company.

VCs consider various factors when choosing companies to fund. They assess the company's financial health, market opportunity, and growth potential before making investment decisions.

A corporate venture capitalist is a type of investor who puts money into companies. They are often involved in mergers and acquisitions (M&As) and can provide significant funding compared to other VCs.

Venture capital funding is a type of financing where investors, known as venture capitalists, provide money to early-stage or startup companies with the potential for significant growth. In return, they receive a stake in the company.

Venture capital funding differs from traditional financing like bank loans in a few key ways:

Risk and Reward: Venture capital focuses on high-risk, high-reward investments in innovative startups, while traditional financing is typically more conservative.

Investment Focus: Venture capitalists invest in early-stage companies with potential for rapid growth, whereas traditional lenders may require a proven track record or collateral.

Returns: While venture capitalists take on more risk, they also have the potential for significant returns if the startup succeeds, unlike traditional lenders who receive fixed interest payments.

Entrepreneurs seek venture capital funding to drive the growth of their startups. This funding can be used for various purposes such as developing products, marketing, expanding operations, hiring, and entering new markets. Additionally, venture capitalists offer strategic advice, industry connections, and mentorship, which are crucial for startups in their early stages.

Venture capital funding is typically provided in stages, which include:

Seed Funding: Supports the initial concept or idea stage.

Series A Funding: Funds product development and early market traction.

Series B Funding: Further financing for scaling the business and expanding operations.

These stages help startups progress from idea to growth and maturity.

Venture capitalists select companies for investment based on various factors:

Market Potential: They assess the size and growth prospects of the market.

Founding Team: They evaluate the strength and experience of the startup's founders.

Product or Service: They look for uniqueness and competitive advantage.

Revenue Projections: They consider the company's potential for generating revenue and growth.

Risk and Alignment: They analyze the level of risk and ensure the startup's goals align with their investment strategy.

By weighing these factors, venture capitalists identify promising investment opportunities.

Venture capital funding provides entrepreneurs with several advantages:

Access to Capital: Entrepreneurs can secure funding without requiring collateral.

Expertise and Guidance: They receive valuable advice and mentorship from experienced investors.

Networking: Opportunities to connect with industry professionals and potential partners.

Credibility: Being backed by venture capitalists enhances credibility in the market.

Long-Term Vision: Venture capitalists have patience for returns, allowing entrepreneurs to focus on long-term growth rather than short-term profits.

While venture capital funding offers advantages, it comes with some drawbacks:

Ownership and Control: Entrepreneurs may have to relinquish ownership and decision-making control to venture capitalists.

High Expectations: VCs often have high return expectations, leading to pressure for rapid growth, which may conflict with long-term strategies or values.

Venture capitalists primarily make money through capital appreciation of their investments.

Investments: They buy equity in startups at early stages. If the company succeeds, the value of their shares rises, enabling them to sell their stake for a profit.

Fees and Interest: Some VCs receive management fees and carry interest from the funds they manage.

The due diligence process is a thorough investigation done by venture capitalists before investing. It includes analyzing the startup's market, competition, finances, legal aspects, team, and growth plans.

This helps identify risks, verify the startup's claims, and determine if it's a good investment opportunity.

Absolutely! Venture capitalists frequently provide ongoing support beyond just financial backing. They offer mentorship, strategic advice, and valuable industry connections to help startups thrive.

Additionally, they may aid in recruiting top talent, refining business strategies, and facilitating introductions to potential customers or partners.

Angel investors are usually wealthy individuals who invest their own money in startups in exchange for equity. They are often hands-on and involved in the company's operations.

In contrast, venture capitalists are professional investment firms that manage funds from multiple sources. They invest in startups at various stages and offer expertise and support beyond just funding.

The equity venture capitalists seek can vary based on factors like the startup's stage and potential. In early stages, they may aim for a substantial stake, typically between 20% to 50%.

As the startup grows and secures more funding, their ownership may decrease due to dilution.

No, venture capital funding isn't restricted to tech startups alone. While tech companies are popular among venture capitalists for their scalability and innovation, VC funds also back ventures in healthcare, biotech, cleantech, e-commerce, and consumer goods.

What matters most is the growth potential, not the industry.

Venture capital investments are patient endeavors, often taking five to ten years or more to yield returns.

Startups need time to grow, refine their products, and expand their customer base. Venture capitalists typically aim for an exit strategy like an IPO or acquisition to realize profits on their investment.

Absolutely! Venture capital funding isn't contingent on a proven revenue model, especially in a startup's early stages. VCs often invest based on growth potential, innovative ideas, or disruptive technology.

However, startups should outline a clear strategy to monetize their product or service and show how they plan to become profitable to attract venture capital.

Absolutely! Startups have several alternatives to venture capital funding. They can consider angel investors, crowdfunding, bootstrapping, grants, or joining incubators and accelerators.

Each option comes with its pros and cons, so it's crucial for entrepreneurs to weigh their choices based on their funding requirements and business objectives.

Absolutely! Some notable examples include Google, Facebook, Amazon, Airbnb, Uber, and SpaceX.

These companies began as startups and received substantial investments from venture capitalists, propelling them to phenomenal growth and industry dominance.

Absolutely! Venture capital funding is a valuable asset for startups venturing into international markets. VCs bring expertise and connections across various regions, easing the path to global expansion.

Moreover, VCs offer strategic advice and can introduce startups to potential partners or customers in new markets, smoothing the entry process.

Venture capital funding poses risks, notably the possibility of losing the entire investment.

Startups often fail, and even promising ones may encounter unforeseen hurdles or fall short of growth targets. Moreover, venture capital investments can be illiquid, requiring investors to wait years for returns.

The venture capital scene has transformed over the years. Initially, it concentrated on backing tech innovations. But now, it's diversified across various industries.

Furthermore, the emergence of angel investors, crowdfunding, and corporate venture capital has widened the funding avenues for startups.

Government regulations and policies play a crucial role in shaping venture capital funding.

They can include tax breaks to incentivize investments in startups, rules governing fundraising and securities, intellectual property protection laws, and initiatives fostering innovation and entrepreneurship. Governments aim to foster an environment supportive of venture capital investments.

Venture capital firms often decline funding applications for several reasons:

Limited Market Opportunity: If the market potential isn't convincing, VCs may pass on the opportunity.

Weak Business Model: A flawed or unsustainable business model can lead to rejection.

Lack of Differentiation: If the startup doesn't stand out from competitors, it may not attract VC interest.

Inexperienced Management: VCs look for competent and compatible leadership; lack of experience or fit may lead to rejection.

Unrealistic Projections: Overly optimistic financial forecasts can raise doubts about the startup's credibility.

Insufficient Innovation: VCs seek innovative ideas; if a startup lacks innovation, it may face rejection.

Startups can improve their odds of securing venture capital funding by:

Forming a Strong Team: Build a team with relevant experience and expertise.

Market Validation: Conduct thorough market research to validate your business idea.

Solid Business Plan: Develop a clear and compelling business plan and pitch deck.

Proof of Concept: Show evidence of market traction or a working prototype to demonstrate viability.

Networking: Build relationships within the startup community and seek introductions to potential investors.

While venture capitalists often prefer a formal business plan, it's not always a strict requirement, especially for early-stage startups.

Instead, startups should focus on presenting a clear strategy through an effective pitch deck, backed by thorough research and understanding of their business, including target market, competition, revenue model, and growth plans.

Absolutely! Venture capitalists frequently invest in international startups. Many firms have a global reach and actively seek opportunities abroad.

However, investing internationally can present challenges like navigating diverse regulations, cultural nuances, and understanding foreign markets deeply.

Yes, indeed! Venture capitalists are often drawn to industries with high growth potential and disruptive innovation. Tech fields like software, AI, biotech, and fintech are particularly attractive. However, it's worth noting that strong growth potential can attract venture capital regardless of the industry. Explore how we support tech startups in securing funding!

After securing venture capital funding, startups commonly encounter hurdles such as:

Meeting Growth Targets: There's pressure to achieve rapid growth, sometimes leading to operational strains.

Scaling Operations: Rapid expansion can be challenging, requiring efficient resource allocation and management.

Decision-Making Control: Founders may face the dilemma of balancing investor expectations with their vision, potentially leading to conflicts.

Cultural Adaptation: Startups may need to align their culture and processes with investor expectations, requiring adjustments.

Navigating these challenges requires strategic planning, effective communication, and a resilient mindset. We provide support to startups in managing these post-funding dynamics.

Venture capitalists frequently offer follow-on funding to startups as they progress. This additional capital supports the startup's growth journey by enabling further expansion and development.

As startups achieve milestones and require more resources, venture capitalists who have already invested in the company may provide follow-on funding. This demonstrates their continued confidence in the startup's potential and helps propel its growth trajectory.